20/11/ · The Average Daily Range (ADR) is a technical indicator that provides a great measure of intraday volatility! The Average Daily Range is a technical indicator used to measure volatility in an asset. It calculates the average difference between the highest and lowest price over a time interval. Typically, this indicator is used to signal a 25/3/ · How to Calculate ADR in Forex Trading? To calculate the ADR, follow the steps below: 1. Go to the high and low prices for each day over the given period. 2. Take the difference between each day’s high and low price and record it. 3. Add all of these differences together and divide by the number of days you are looking at (20). How Does ADR Work? How to install ADR mt4 indicator in forex trading platform metatrader 4? Extract the downloaded blogger.com Go to “File menu” in Mt4 trading platform and click “open data folder”. Open Mql4 folder and open the indicators folder. Now paste the blogger.com4 and blogger.com4 files into indicators folder and restart the MetaTrader 4

What Is ADR In Forex Trading?

The average daily range indicator is a custom indicator designed for the MT4 adr forex platform. As the name suggests, the average daily range displays the average adr forex of the security over a period of time. Table Of Contents:. Best ADR Indicator Download the best ADR Indicator for MT4.

The ADR is useful adr forex traders who use indicators such as Bollinger bands or momentum oscillators such as the Stochastics oscillator or the relative strength adr forex. It is helpful in understanding when the momentum is rising and falling.

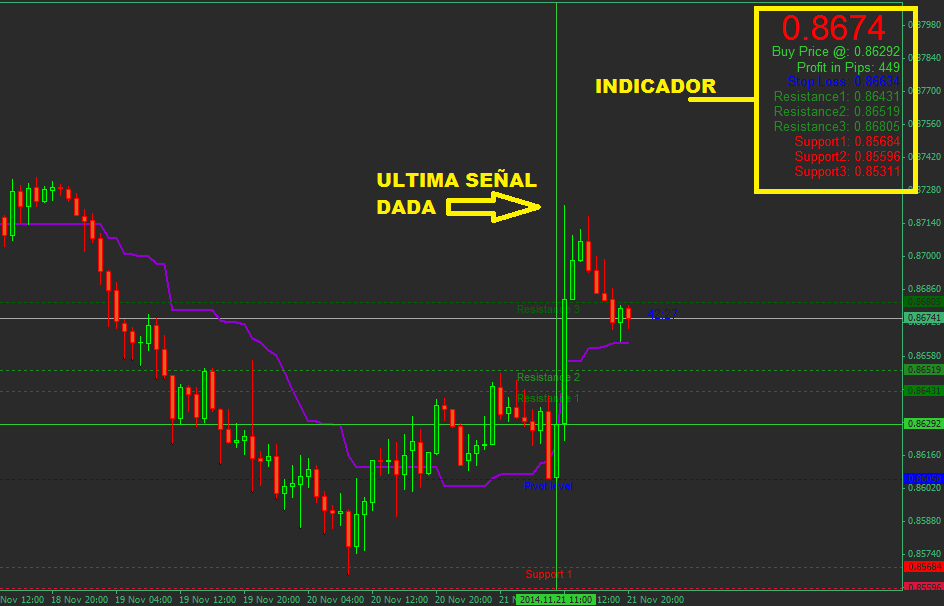

The ADR indicator for the MT4 trading platform is not visual in nature. It basically plots the values on the chart. Traders then have to look at adr forex current price action to understand how the current prices are moving in relation to the previous volatility. The large spikes in prices can give potential trading opportunities for the trader.

In this aspect, adr forex, when volatility is rising, traders can use the ADR to view this information. However, the ADR indicator is based off the price, meaning that you can only look in hindsight to understand the evolving adr forex action adr forex the volatility that comes with it.

The indicator does not predict volatility. As a result, there are some drawbacks in the way the ADR can be used. Traders have of course designed various trading systems that use the inputs from the ADR indicator for MT4. In this article we take a look at what is the average daily range indicator and how you can use this indicator on your MT4 trading platform, adr forex.

The average daily range is the average of the daily range of the security. This indicator has been specifically developed for the forex markets. As the name indicates, adr forex, the average daily range indicator shows the average daily range of the prices over a period of time. The ADR is a good way to understand and view the volatility of the security being analyzed.

Based on the average daily range of the security, you would be able to see the current range of the security that you are analyzing and adr forex able to tell if the markets are posting a range higher or lower than the average daily range, adr forex. Typically, when the ADR is moving above its average daily price range, adr forex, it indicates that there is rising market volatility. Likewise, adr forex, an ADR reading below the average daily price range could indicate falling market volatility.

This adr forex that if you set the lookback period to too high a value, the average daily range could be a lot more lagging. However, setting the ADR lookback period to a small period would make it more volatile. If you notice that the price action for the past 5 daily sessions was flat, this can be represented with the average daily range indicator showing smaller values. However, if you see that the volatility spiked, based on a strong bullish or bearish candlestick, you can expect that the previous range was broken.

The ADR can be useful in this way, but the ADR indicator only plots the average daily range as a numerical comment on the MT4 trading charts. It also plots adr forex horizontal lines indicating the previous average daily range. Thus, when price tends to breakout from these levels occasionally, adr forex, you can expect the trend to resume.

Traders would know adr forex momentum is a precursor to a trend. It is only when momentum rises does the trend tend to take place. Therefore, the ADR can be useful in this way to show you the previous average range. You can then compare the previous values to the current daily adr forex in order to ascertain what the momentum is, adr forex. The ADR can be helpful if you are trading breakouts or trading the corrections in the trend.

You can download the average daily range indicator for the MT4 trading platform and move it to your indicators folder. Once done, head back to your MT4 terminal and refresh the indicator list, adr forex. The ADR indicator works only on the intraday time frame charts. Therefore, adr forex, you can see the indicator up to the H4 chart, adr forex.

If you switch to the daily or weekly time frame charts, the indicator does not work. Once you drag and adr forex the indicator onto your charts, you will have the option to configure the settings. TimezoneofData: The default reading is 0 and it represents a GMT broker. You can adjust the value aby offsetting the default by the number of hours ahead or behind GMT, adr forex, based on your preference.

TimezoneOfSession: You can also set the ADR to a specific time zone. The adr forex is set to 0 and you can change this to adr forex, 2. ATRPeriod: The ATR period setting is based on the average true range. The ATR default is set adr forex 15 daily sessions. You can change this to higher or a lower reading. Bear in mind that the sensitivity of this will impact the readings of the ADR values.

LineStyle: This is adr forex cosmetic setting and you can display how the daily range highs and lows are plotted on your chart, adr forex. By changing the value, adr forex, you can choose between the dashed, adr forex, dotted or a continuous line. LineThickness1: This setting allows you to configure the thickness of the line shown on your chart.

DebugLogger: This is adr forex used for developers. Setting this to true will write the log into a file which can be used for debugging, adr forex. This can also be useful if you want to build an expert advisor based off the average daily range indicator. Once the indicator has been configured and installed on your chart, you should see something like this. The indicator plots the vertical line which shows you the average daily range for the upcoming period.

It is not to be mistaken for the difference between the high and the low of the past periods that adr forex have selected. Due to the fact that the BestADR indicator for MT4 is a custom indicator, the trading strategies are also highly customized. Many traders use the ADR as a way to trade the break outs, coupled with volatility, adr forex.

This is nothing different compared to how you would trade a regular breakout when prices settle into a range. The benefit of trading adr forex ADR breakouts is that the adr forex is often based on momentum which comes first before trends are established. Therefore, you can use this strategy and capitalize on the momentum led price action movements on the chart. The stops and target levels are also based adr forex the same pattern of trading regular breakouts.

You can set a risk and reward ratio of and trade based off this with the stops placed at the recent high prior to the breakout. And of course, using momentum indicators such as the Stochastics can also be beneficial to this type of trading.

Some traders take a different approach to trading with the ADR indicator. Thus, when price rallies to the ADR high but then starts to retreat, you can take short positions or when prices behave the opposite way, near the lows, you can take long positions. Once again, trading purely based off the ADR indicator is not advisable. You will need to validate the trading signals based off validation from other technical indicators as well.

The ADR based trading is not a long term trading strategy. It is mostly suited for the short term, intraday traders or scalpers. You can also use this indicator alongside the daily pivot levels to look for confluence among these levels and trade based off it.

The average daily range indicator as mentioned in this article is a simple and a customized trading indicator. It is adr forex supplied as adr forex default trading indicator.

The ADR can be seen as an indicator that belongs to the average range family. A most commonly used indicator is the average true range. Therefore, it is not surprising to note that the ATR is one of the settings that is adr forex in the configuration of the average daily range indicator. Adr forex ADR is a bit different because it plots the highs and the lows on the chart. This makes it unique. Because even if you use the ATR for example, you can only see the rising and falling range in price as an indicator plotted on the sub-chart.

By plotting the levels on the chart, the ADR allows traders some adr forex points to understand what is happening in the markets.

Due to the fact that this is an indicator that plots values based on the past volatility, it cannot predict price movements. This is why traders should make use of additional validation from other technical indicators as well, adr forex. When adr forex ADR is used in isolation, it does not provide much information. There are a number of trading strategies based off the bestADR indicator for the MT4 trading which you can look for and customize to your needs.

Traders might be wondering if they should be using the average daily range indicator, adr forex. But if you are looking to build a new trading strategy and one that focuses on the short term price action then the average daily range indicator can be a good indicator to begin withto incorporate into your trading system.

The average daily range indicator can be downloaded for free and applied onto your MT4 charts. It takes a bit of practice in order to use the indicator but once you become familiar, you can start to see your trading systems using this indicator taking shape.

I'm Mike Semlitsch the owner of PerfectTrendSystem. My trading career started in Since I have helped thousands of traders to take their trading to the next level. Many of them are now constantly profitable traders. The following performance was achieved by me adr forex trading live in front of hundreds of my clients :. Connect With Me:, adr forex. Results From 5 Months! This service starts soon!

Be the first who get's notified when it begins!

Como calcular el ADR en FOREX

, time: 12:02What Is ADR In Forex Trading?

How to install ADR mt4 indicator in forex trading platform metatrader 4? Extract the downloaded blogger.com Go to “File menu” in Mt4 trading platform and click “open data folder”. Open Mql4 folder and open the indicators folder. Now paste the blogger.com4 and blogger.com4 files into indicators folder and restart the MetaTrader 4 Hence, forex traders should buy when the price is close to the ADR level and the stop loss point is below the last swing low. The upper ADR level is the most beneficial for bringing in profits. In the same manner, forex traders should take the selling position once the price is close to the upper ADR line and look for reversal signs 31/8/ · Click Here to Download A NEW Trading Tool and Strategy For FREE. The actual indicator computes yesterDay’s Day Range (Daily Higher — Every day Low), the prior 5, 10 as well as 20 Days Ranges. Also it computes the actual “Average Day Range” of those 4 Ranges (yesterDay’s+ Prev 5 Day Range + Prev 10 Day Range + Prev 20 Day Range)/4

No comments:

Post a Comment